Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

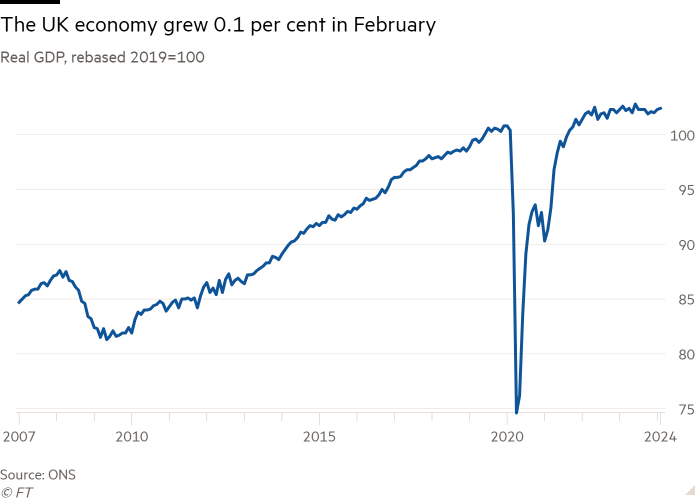

The UK economy grew for the second month in a row in February, driven by expansion in manufacturing, raising hopes the UK is emerging from a technical recession.

Gross domestic product rose 0.1 per cent between January and February, the Office for National Statistics said on Friday.

That was in line with analysts’ expectations and down from January’s 0.3 per cent revised monthly growth.

Services output grew by 0.1 per cent in February, while manufacturing increased by 1.2 per cent. Construction output fell by 1.9 per cent.

Sterling barely moved on the news; it was down 0.15 per cent against the dollar at $1.2526 shortly after the announcement.

February’s figure raises the likelihood that the UK economy expanded overall in the first quarter, marking the end of the technical recession it slipped into at the end of 2023 after two consecutive quarters of negative growth.

“GDP would need to fall by an unlikely 1 per cent month-on-month or more in March for the economy to contract in the first quarter as a whole,” said Paul Dales, chief UK economist at Capital Economics.

“As a result, we can safely say that, after lasting just two quarters . . . the recession ended in Q4,” he added.

A small increase in March GDP would result in a 0.4 per cent expansion in the first three months, which could be stronger than the 0.1 per cent forecast by the Bank of England, according to Dales.

He predicted the stronger economic growth would not prevent inflation from falling, allowing the BoE to start cutting interest rates from their 16-year high of 5.25 per cent from June.

The latest figure will be a boost for UK Prime Minister Rishi Sunak, who has pledged to grow the economy as he heads into a general election expected this year.

The Conservative party trails Labour by roughly 20 points in opinion polls.

In the three months to February, the economy grew 0.2 per cent compared with the previous three months, marking the first expansion since August 2023.

Jeremy Hunt, the chancellor, said the figures were “a welcome sign that the economy is turning a corner, and we can build on this progress if we stick to our plan”.

Hunt is hoping that growth data published in May will show that Britain has moved out of the mild recession it entered at the end of 2023, removing a political weight from the Conservatives ahead of the election.

But while growth is returning to the UK economy and inflation is expected to soon fall below the BoE’s 2 per cent target, there are clouds on the horizon for the chancellor.

Market expectations for BoE interest rate cuts in 2024 have retreated, pushing back the prospect for the start of a rate-cutting cycle that Hunt believes will shift public sentiment on the economy.

After the publication of the GDP figures, markets continued to place an 80 per cent probability of the first quarter-point cut being delivered by August, with only two cuts priced in by the end of the year.

Hunt said on Friday: “Last week our cuts to national insurance for 29mn working people came into effect across Britain, as part of our plan to reward work and grow the economy.”

The ONS said growth was widespread across the manufacturing sector with an expansion reported in 11 of the 13 subsectors, with strong growth in car and food production.

Services output also grew, with public transport and haulage, and telecommunications performing strongly.

In contrast, construction output was hit by wet weather and fell.