Binance's latest token listing is drawing intense attention from traders as Polygon's MATIC goes through a critical transition.

With market expectations rising, the newly listed POL token could be subject to extreme volatility. Early indicators suggest investors are watching closely to see how the move will impact prices.

Binance Lists POL Polygon

Binance has successfully completed the MATIC token swap to POL, allowing users to deposit and withdraw new POL tokens.

Spot trading for POL/BNB, POL/BRL, POL/BTC, POL/ETH, POL/EUR, POL/FDUSD, POL/JPY, POL/TRY, POL/USDC, and POL/USDT pairs commenced on September 13, 2024, 10:00 UTC. Additionally, Binance has enabled trading bots and spot copy trading for these pairs, which will become available within 24 hours of listing.

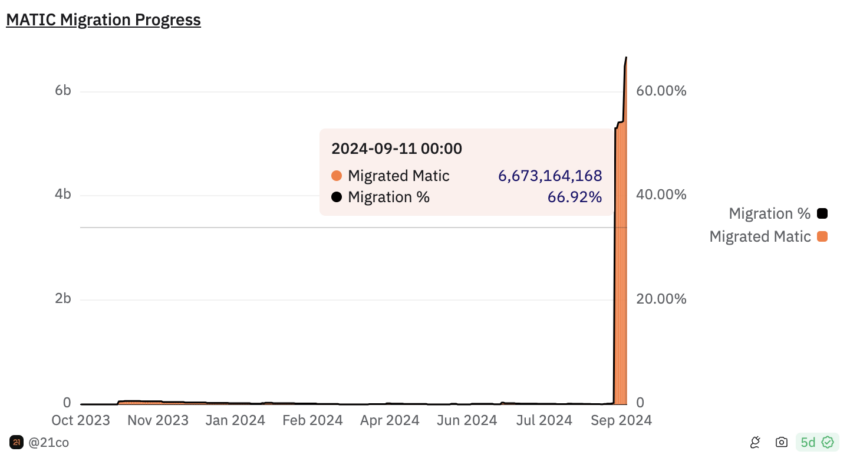

As of today, 6.67 billion MATIC tokens have been converted into POL as a result of this token migration. This represents approximately 66.92% of the total supply.

Read more: How to convert MATIC to POL

MATIC to POL migration progress. Source: Dune

Market watchers noted that POL initially hovered below $0.40. However, an influx of buying volume exceeding $70 million pushed the price higher, reversing the downward trend and shifting technical indicators to a bullish outlook.

Analysts like Josh Olszewicz predict POL could rise above $0.57, with a likely pullback before it reaches the $0.60 resistance zone. Meanwhile, Spencer Noon points to the network's opportunity as it “remains a top destination for builders.”

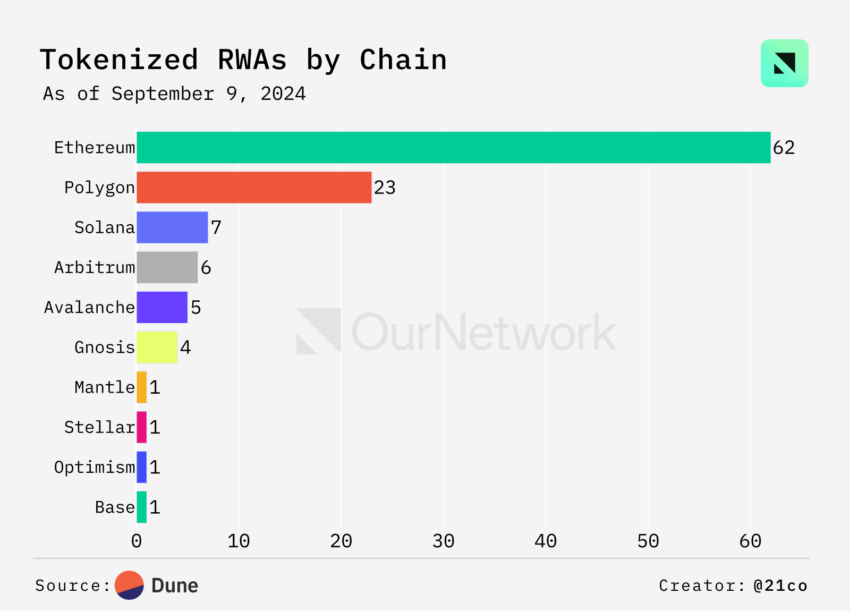

“Polygon is the second-largest blockchain for tokenized RWAs, with 23 assets second only to Ethereum’s 62. This positions Polygon as a significant player in the space — the platform’s total RWA market cap is $531.58 million,” Noon wrote.

Read more: Polygon (POL) Price Prediction 2024/2025/2030

RWA Blockchains. Source: OurNetwork

As the broader crypto market prepares for the next quarter, there is optimism that POL can continue its upward trajectory. Sustained bullish sentiment could push the token to reclaim the $1 mark. While reaching a new all-time high may prove challenging, the outlook for POL remains positive.

All eyes will be on POL in the coming days to see if it can maintain momentum and break through key resistance levels, potentially positioning itself as a major player in the market.