Stay informed with free updates

Simply sign up to the Equities myFT Digest — delivered directly to your inbox.

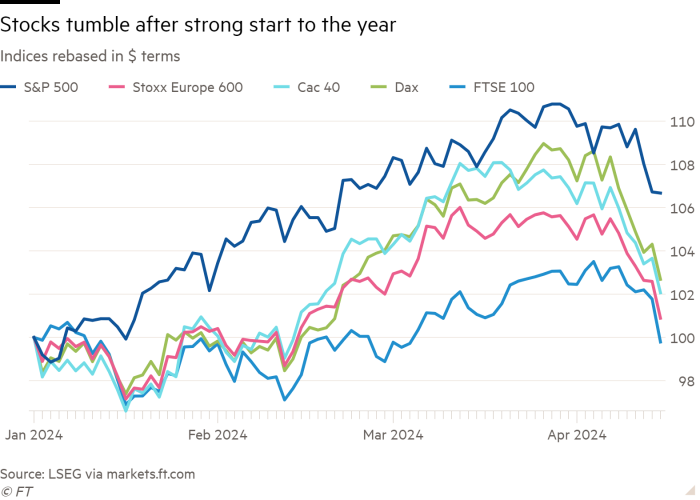

European stock markets suffered their worst day in nine months as a sell-off sparked by receding hopes for rapid US interest rate cuts spread around the world.

Indices in Europe and Asia fell sharply, following Tuesday’s steep declines on Wall Street after strong US retail sales figures that suggested the Federal Reserve might cut rates this year by less than previously thought.

The region-wide Stoxx Europe 600 fell 1.5 per cent in its biggest one-day drop since last July. London’s FTSE 100 fell 1.8 per cent, also its worst day in nine months, as declines in Europe were led by energy groups, banks, and miners, which are over-represented in the commodity-heavy index.

Wall Street’s benchmark S&P 500 was down 0.1 per cent by early afternoon in New York, as was the tech-heavy Nasdaq Composite, narrowly extending steep declines from the previous trading session. The S&P 500 recorded its worst two-day streak on Friday and Monday since the regional banking crisis in March 2023.

Hong Kong’s Hang Seng, South Korea’s Kospi and Japan’s Topix all dropped more than 2 per cent, while China’s CSI 300 fell 1.1 per cent.

“This is basically forcing the equity market to wake up to the reality of less Fed cuts,” said Emmanuel Cau, a strategist at Barclays.

Expectations of fewer US rate cuts have also sparked a slump in emerging market currencies against the dollar, prompting interventions by Asian central banks, including Indonesia and South Korea.

Investors said Iran’s weekend attack on Israel added to anxiety that equity markets had rallied too far, too fast this year.

“The market is looking for an excuse to take a breather and we have the perfect storm,” said Florian Ielpo, head of macro at Lombard Odier Investment Managers.

“Geopolitical risks are leading to higher commodity prices and that’s combining with existing inflation and interest rate anxieties. The year-to-date performance was just too stellar to remain that way,” he added.

As the shifting interest rate expectations hit currency markets, the Indonesian rupiah slipped 2 per cent to Rp16,176 against the dollar, its lowest point in four years.

Bank Indonesia’s governor Perry Warjiyo said on Tuesday that the central bank had stepped in to support the rupiah, which had dropped about 5 per cent this year and was one of the worst-performing currencies in Asia.

India’s rupee fell 0.2 per cent to a record low of Rs83.64 against the dollar and the Malaysian ringgit was trading close to a 26-year low, down 0.3 per cent at RM4.79, a day after Malaysia’s central bank said it would “manage any risks arising from heightened financial market volatility”.

The Korean won dropped as much as 0.9 per cent to Won1,400, a 17-month low that led the finance ministry and Bank of Korea to say in a joint statement on Tuesday that they were “closely watching forex moves and supply and demand with special caution”.

The retreat from assets and currencies perceived as relatively risky follows figures that indicated growth in China was stronger than expected in the first quarter.

However, disappointments in industrial output and retail sales raised some concerns about the country’s recovery at a time when the strength of the US economy was driving global markets.

Inflation risks will be central to discussions among policymakers at the World Bank and IMF spring meetings in Washington this week, particularly after large rises in commodity prices in recent weeks amid fears of supply disruption sparked by the conflict between Israel and Iran.

Traders had already slashed their bets on rate cuts by the Fed last week after official data showed a 3.5 per cent increase in consumer prices for the year to March, up from 3.2 per cent in February and higher than expectations.

Investors now expect one or two Fed rate cuts this year from the current 23-year high of 5.25 to 5.5 per cent, compared with expectations of at least six at the start of 2024.